You’ve got options, like repayment help from your employer and coaching from a mortgage broker.

You want to buy a house. But you’re worried you won’t qualify for a mortgage because of your student loan debt. You’re not alone. Half of non-homeowners (51%) say student loan debt is delaying them from buying a home, according to a survey from the National Association of REALTORS®. That number jumps to 60% for millennials.

The numbers tell an ugly story of a generation paying for its education long after graduation. As a result, they’re having to make hard life choices for decades. The average public university student borrows $30,000 in student loans to get a bachelor’s degree, according to the Education Data Initiative. The average student loan payment is $460 a month. And nearly 48 million people have student loans.

Student debt is no longer just a first-time home buyer problem, says Cale Iorg, a loan officer at Supreme Lending in Alpharetta, Ga. “We get people in their 40s and 50s who are still paying off student loans. They went back for a master’s degree, or they are parents who cosigned their children’s student loans.”

President Biden provided some relief (not reflected in the previous numbers) when he announced in late August 2022 that he would cancel $10,000 in student loan debt for those earning less than $125,000 per year. The relief includes an additional $10,000 for those who received Pell grants for low-income students.

Before the pandemic, more than 8 million people — one in five borrowers with a payment due — had defaulted on their loans, the “New York Times” reported. But because many of them carried relatively small balances, they’ll now be eligible for loan cancellation.

Student loan payments have been paused since March 2020, but are scheduled to resume in January 2023.

Despite uncertainty about debt cancellation timing and impact, you can get a mortgage while you have student debt. Here are eight tips for making it happen.

#1 Lower Your Debt-to-Income Ratio

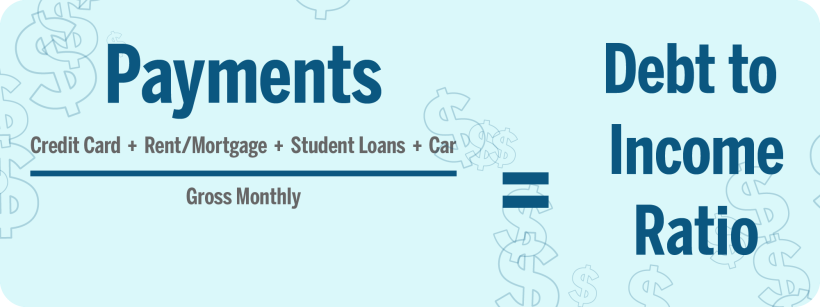

Your debt-to-income ratio, or score, is one of the most impactful numbers on your life since your ACT score. It measures the percentage of your monthly income that goes to pay your debts. You calculate it by adding all your monthly debts – credit card minimums, rent or mortgage, car payments, and, yes, student loan payments. Then, you divide the total by your monthly gross income (take-home pay before taxes and other monthly deductions).

Your debt-to-income ratio should be no more than 45% of your gross monthly income, Iorg says. Many lenders consider the ideal debt-to-income ratio, including a mortgage payment, to be 36% or less. Depending on your credit score, savings, assets, and down payment, lenders may accept higher ratios, according to Bankrate. It depends on the type of loan you’re applying for.

You can improve your debt-to-income ratio three ways: Make more money, spend less money, and pay down your debt, Iorg says. “Not everybody can wake up tomorrow and say, ‘Oh, well, I’m going to get a job that pays $4,000 more a month,’” he adds. Sure, there are always side hustles to bring in extra bucks to help you pay down bills. “But the surest way to improve your debt-to-income ratio is to live within your means.”

And pay down those student loans.

#2 Increase Your Credit Score.

Your credit score is the other number that profoundly affects your financial fortune. It’s basically a grade for what kind of a job you do paying your bills. The simplest ways to boost your credit score include paying your bills on time, using less than 30% of the credit limit on your credit cards, and paying off debts. There’s a lot of help out there, including free webinars, to guide you on improving your score. Generally, these tips involve paying off bills and spending less money. Yes, frugality.

#3 Look for Down Payment Assistance.

When you’re paying off student loans, saving for a down payment can be tough. The down payment can range from 3.5% to 20% of the home purchase price. If you don’t have a relative who can dump a chunk of cash on you – known in the mortgage biz as gift money – there’s other help. Down payment assistance programs offer loans or grants that pay the down payment on a house. Some DPA funds can be used toward closing costs, too.

Most DPAs require you to be a first-time home buyer with a credit score of 640 or higher and a moderate source of income. DPAs are usually offered at the local level, and their eligibility rules vary by state, city, or even ZIP code. In Seattle, for instance, you can get up to $55,000 in down payment assistance in the form of a low interest loan, depending on your household size and income. The buyer must pay just 1% down out of pocket, and the DPA pays the rest. In Georgia, a DPA offers loans of $7,500 for most buyers. Teachers, health care providers, active duty service members, and public employees are eligible for $10,000.

#4 Get a Co-Borrower.

Want to instantly improve your chances of getting a mortgage? Put a co-borrower on your mortgage. Their income counts toward the debt-to-income ratio, and their credit history bolsters yours. You’re combining forces to strengthen your financial qualifications, and that can offset the dead weight of your student loan debt.

“Co-borrowers are not uncommon,” Iorg says. “It’s a good way to go for a buyer who just doesn’t have enough money from their monthly income to qualify for a mortgage.” Iorg says the co-borrowers he sees are usually parents, siblings, or grandparents. Most co-borrowers are family members or someone with whom the homeowner has a personal relationship. But lenders don’t require a co-borrower to produce proof they know you or are related to you. They just want proof the co-borrower can pay your mortgage if you don’t.

Remember, a co-borrower will share title on the home. If that’s not your cup of joint ownership, consider a co-signer. Their income will boost your financial profile, but they won’t be a co-owner of the house.

#5 Look into Student Loan Protection Programs.

You could be eligible for loan forgiveness if you’re a teacher, attended a for-profit school that went out of business, or have a total and permanent disability. Here are the programs erasing student debt:

- Public Service Loan Forgiveness: This program has been around since 2007 to grant debt relief to teachers, social workers, firefighters, employees of nonprofits, and other public servants. But the Biden administration loosened the rules to make more people eligible. According to the U.S. Department of Education, the PSLF has forgiven $2 billion in student loans and is still going.

- Borrower Defense and Closed School Discharge: You may also be eligible for debt relief if you attended a school that turned out to be scamming you. Hello, ITT Tech, DeVry University, and Corinthian Colleges. Thanks to rules under the Biden administration, defrauded students who got only partial debt relief under the Trump administration can now get the rest of their student loans wiped out.

- Total and Permanent Disability Discharge: Borrowers with permanent disabilities that prevent them from working can shed their student debts, thanks to changes to an existing program that the Education Department says will help at least 370,000 borrowers drop more than $6.5 billion in student debt.

#6 Get Help from Your Employer to Repay Student Debt.

Some companies are offering student loan repayment assistance as a benefit. Google matches employee payments up to $2,500 a year; Aetna matches up to $2,000 a year with a lifetime cap of $10,000; and Fidelity Investments pays up to $10,000 of an employee’s student loans. Other companies that offer payment assistance include Carvana, Chegg, Hulu, Lockheed Martin, New York Life, and PwC (PricewaterhouseCoopers).

Employer-sponsored student loan repayment may become more common. The Coronavirus Aid, Relief and Economic Security (CARES) Act of 2021 gives a tax break to companies that offer student loan repayment assistance. From now till Dec. 31, 2025, employers can contribute up to $5,250 a year tax-free to an employee for repayment of student loans. So, if your boss gets on board this year, you could get as much as $15,000 of your loans paid off before the program ends.

#7 Lower Your Student Loan Payments.

You can do this in one of two ways:

- Opt for an income-based repayment plan for federal student loans. You can apply for loan repayment plans that will lower your monthly payment on a federal student loan based on your income and family size. The basic income-based repayment plan caps your payments at 10% of your discretionary income. It also forgives your remaining loan balance after 20 years of payments. That can go a long way toward lowering monthly debt payments and your debt-to-income ratio.

- Refinance your private student loans. This is a good idea if you have private student loans that aren’t eligible for federal loan forgiveness or have variable rates. If you can get a lower interest rate, you can change your life. For example, if you have $30,000 in private student loans with an 8% interest rate, you’ll pay $364 for 10 years. Refinance that to a 15-year loan at 4% interest, and your payment drops by $142 a month. You’ll also save around $3,735 in interest over the life of the loan.

#8 Get a Mortgage Broker Who Will Coach You.

Look for someone who is experienced at working with borrowers who have more student debt than they’d like. Get a broker who will work with you to find DPA programs; steer you through the ins and outs of FHA, conventional, and VA loans; and help you get your finances in order so you become a better mortgage candidate. Iorg says his office has a credit analyst whose job is to help clients improve their credit scores and debt-to-income ratios.

The Bottom Line

There’s no quick fix to buying a house when you have student loans.

The good news is there’s more public support for student debt forgiveness. Many economists say forgiving student loans, such as the Biden plan for debt cancellation, would put money back into Americans’ pockets. That would boost the economy and encourage the formation of more businesses and households. More businesses means more jobs, and more households means more spending. And spending fuels the U.S. economy.

Recent events have reinforced that changes are the norm for student loan debt and relief. Changes to the PSLF program have made more people and more types of federal loans eligible for forgiveness. Add to that the raft of assistance programs that help renters become first-time home buyers, and you may be able to afford it all: a college education, a mortgage, and a 401(k) contribution. You just may not be able to do it all at once. It will take planning and time.